The ABC of Lithium Triangle

...and China's dominance over it (Argentina-Bolivia-Chile) in the Andes.

Climate change is reshaping the energy paradigm. This shift is linked to emerging key green technologies—in this case, photovoltaics and wind energy and Lithium‐ion (Li‐ion) batteries— and the massive amount of minerals and metals that will be required to create them. Li‐ion battery (LIB) cells demand a variety of resources such as lithium, nickel, cobalt, manganese, aluminum, copper, silicon, tin, titanium, and carbon (natural graphite). Many of these elements are considered “critical raw materials” due to risks in their supply, their economic relevance, concentration of reserves, and low levels of substitutability (Boon‐Brett et al., 2017).

For this article, our focus will rest on lithium.

Lithium is a strategic yet not scarce resource. It is found in a wide range of forms in nature, mostly in low concentrations. To date, it is economically feasible to extract lithium from two sources—brines (continental and geothermal brines) or “hard rock” (pegmatites, hectorite, and jadarite). Brines represent approximately 50% of the global reserves (Heredia et al., 2020).

Lithium and its derivatives have different industrial uses; lithium carbonate (Li2CO3) is used in glass and ceramic applications, as a pharmaceutical, and as cathode material for lithium‐ion batteries (LIBs). Lithium chloride (LiCl) is used in the air‐conditioning industry while lithium hydroxide (LiOH) is now the preferred cathode material for lithium‐ion electric vehicle batteries (Alessia et al., 2021).

The most important market for lithium and LIBs is in electric vehicles (EV).Today, EVs account for less than 0.55% of the global car fleet, but it is projected that by 2040, some 31% of the global passenger vehicle fleet will be electric (Heredia et al., 2020). According to International Energy Agency (IEA, 2021), the global electric car stock surpassed 10 million electric cars on the world's roads in 2020, with more than half of global sales of electric cars taking place in China.

In the coming decade, the global battery consumption is expected to increase five‐fold, while lithium demand has already increased from 70,000 tons in 2020, to 93,000 tons in 2021 (USGS, 2022). The demand for lithium in the coming decade would be approximately 250,000 tons to produce enough electric cars to replace their gasoline equivalents (Pyakurel, 2019).

Li‐ion battery technology will revolutionize how we produce and consume electricity.

China has become a particularly important country in the energy transition as the world's largest producer, exporter, and installer of solar panels, wind turbines, batteries, and electric vehicles (Kerry & Khanna, 2019).

THE LITHIUM TRIANGLE

It is estimated that the so‐called “lithium triangle” in the salt flats of Bolivia, Chile, and Argentina account for 56% of the world resources, 52% of world reserves, and one‐third of the world production, as of 2021 (USGS, 2022). This geographical concentration makes this region an important site for the global industry, with different actors seeking to extract lithium.

Dorn and Peyré (2020) note that in the geopolitics of lithium, the Lithium Triangle does not have a privileged geographic concentration of resources since lithium is found in different forms and locations around the globe. They point out that the low cost of extraction from brines (in ABC) is a relative advantage that might be lost if other forms of extraction (with lower costs) develop over time and in other locations.

An important geopolitical perspective is the nature of Chinese access to lithium. Kalantzakos (2020) argues that the Chinese strategy to secure lithium is geared to maintain a dominant position in downstream industries and the overall command of the upstream supply chain. Beijing’s growing influence in Latin America explains this.

Lithium is now considered as a critical resource in all three major regions of the United States, the European Union, and China.

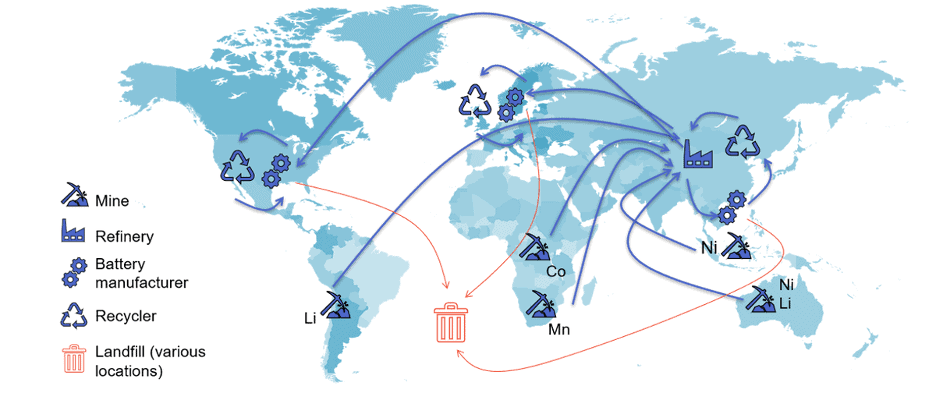

THE LITHIUM SUPPLY CHAIN

The Lithium Triangle in South America contains 52% of world reserves. To date, except in Bolivia, there are US, Chilean, Chinese, Canadian, and Australian companies extracting lithium in the region.

In 2021, Australia, Chile, and China accounted for 94% of Li production worldwide (USGS, 2022). Over the past years, Chile has lost its leading role in the global market of lithium as Australia rapidly expanded its hard‐rock mining operations (Kalantzakos, 2020).

Let’s take a closer look at the Chinese Monopoly of the Lithium maket:

The processing and refining of raw material into lithium hydroxide and lithium carbonate is a key stage in capturing more value in the upstream LIB supply value chain. Today, most of the capacity is concentrated in China.

In terms of battery components (cathodes, anodes, separators), more than 65% of the capacity is concentrated in China, followed by Japan. The battery manufacturing capacity is even more concentrated in China (75%), followed by South Korea (15%).

The last stages of the LIB value chain (assembly and distribution) are the most competitive, Once again, China concentrates 60% of battery assembly and dominates almost half the market of EVs and hybrid vehicles (43%).

GIGAFACTORIES

Gigafactories are a key indicator of who will dominate the platform technology for EVs, and where. The term—coined originally by Tesla—refers to huge‐scale manufacturing facilities for producing electric batteries (for EVs and energy storage). Capacity is measured in gigawatt hours (GWh).

Europe has only 25% of Gigafactories, whereas Asia concentrates 71% (with China leading the capacity, with 69%). Although Europe and the United States are planning to double their current capacity, they are well behind China.

For countries like China, renewable energies are central in government policies not so much for security access but for the country's economic and industrial goals in terms.

THE CHINESE DOMINANCE IN THE LITHIUM TRIANGLE

The Lithium Triangle hosts more than 70 salt flats, the most important of which are the Uyuni in Bolivia, the Atacama in Chile, and Salinas Grandes in Argentina. The three countries share an immense amount of lithium but contrast substantially in their governance regimes, levels of development, and lithium‐mining strategies.

The gross domestic product (GDP) of Chile and Argentina is 7 to 11 times bigger than that of Bolivia. Bolivia has a lower level of industrial development and competitiveness, whereas Chile and Argentina have medium levels.

In terms of financial resources, since 2005, China has granted approximately US$86 billion in loans to Latin American countries, an amount greater than the World Bank (WB) and the Inter‐American Development Bank combined (Stallings, 2020).

Argentina has the fourth‐highest bilateral debt (US$17.1 billion) in the South American region, and, like for Bolivia, China has become the largest bilateral creditor (US$3.4 billion) (Agramont & Bonifaz, 2018; The Dialogue, 2020). In Chile, China has taken on a trade strategy rather than foreign loans; the Chinese market is one of the most important for exports, in particular Chilean copper.

From 2017 to 2020, China has increased its presence in Australia, Democratic Republic of Congo, Argentina, Bolivia, and Chile. Of the investments over this period, one‐third took place in Argentina.

Of the triangle countries, Bolivia is the one that has a high degree of dependence on China.

Whether lithium has the potential to foster a more sustainable and just energy transition, or it will reproduce the same patterns of dependence albeit under a new conjuncture of powerful actors will be contingent on how power imbalances are addressed in economic, technological, and social terms.