A watershed moment in India's digital evolution occurred on December 1, 2022, when the Reserve Bank of India (RBI) launched e-Rupee, also known as Central Bank Digital Currency (CBDC). What may puzzle a neophyte is how e-Rupee differs from NEFT, RTGS, and our trusty superhero, UPI. All of these payment methods are secure, effective, and available 24/7, so why is there a need to introduce another mode of payment?

To grasp this, we must first acquaint ourselves with the concept of cryptocurrency— which is a digital form of currency, and an alternative to physical cash payments. Cryptocurrency transactions are recorded and verified in a decentralized system using encryption. The foundation of cryptocurrency is the "Blockchain," similar to a digital ledger, distributed across various computers, making transactions immutable. These distributed computers, known as "nodes," ensure traceability, speed, and security across the entire crypto network.

One of the most notable cryptocurrencies is Bitcoin, launched in 2009 by an anonymous entity known as Satoshi Nakamoto. It sparked a global frenzy, giving rise to numerous digital currencies such as Litecoin, Ethereum, XRP, Tether, and more. Despite the fervor for these alternative financial assets, there are a few major concerns. First, there is no central bank or regulatory body to provide security, leaving no recourse if money is lost. Second, as digital assets, they are vulnerable to hacks, theft, and even shutdowns due to blockchain malfunctions or cyberattacks. Finally, the high volatility of these assets have the potential to disrupt the entire financial system (financial bubble, y’all?).

Several nations, including China, Egypt, Nepal, Morocco, Qatar, Tunisia, Bangladesh, Iraq, and Algeria, have banned cryptocurrencies, citing concerns over money laundering and market volatility.

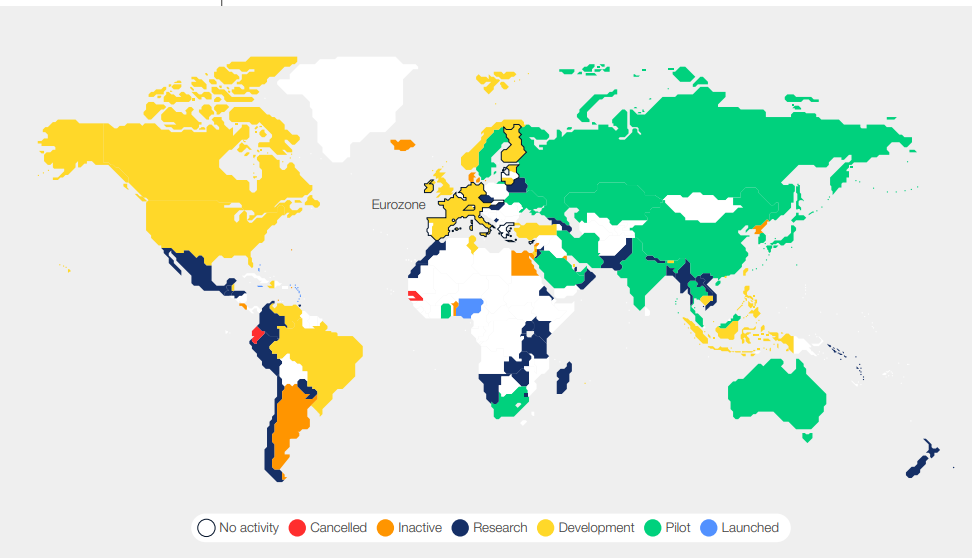

In 2019, the Bahamas introduced the world's first retail CBDC, the Bahamian Sand Dollar, which pegged to the US dollar. China's People's Bank of China (PBoC) initiated a pilot CBDC in regions such as Shenzhen, Suzhou, Xiong'an, and Chengdu in the same year. The Central Bank of Nigeria followed suit in October 2021 with eNaira. Notably, the United Arab Emirates and Saudi Arabia collaborated on Project Aber in 2019 to facilitate faster cross-border transactions.

While Europe continues to research the viability of CBDCs, the UK remains uncertain about their adoption. In 2020, the Biden administration initiated Project Hamilton, a collaboration between the Boston Fed and MIT, dedicated to investigating the possibilities of digital currencies.

India's stance on cryptocurrencies started with an outright ban in 2016 to drafting a bill in 2019 to prohibit crypto activities. The Supreme Court of India lifted the ban on cryptocurrencies March 4th, 2020. Thereafter, in 2022, a high-level Inter-Ministerial Committee (IMC) recommended prohibiting all private cryptocurrencies except those issued by the Central Bank (Anulekha, 2022).

In the 2022-23 Budget, it was announced that cryptocurrencies would be taxed at 30%. However, this did not legalize them, as in India, taxes are payable even for illegal income and capital gains. The same budget revealed the launch of India's own Central Bank-backed digital currency, e-Rupee.

E-Rupee is a digital version of India's fiat currency and is accessible through digital wallets or personal banking applications. In contrast to UPI, NEFT and RTGS, where transactions take place directly from bank accounts, e-Rupee necessitates users to “load” money into their digital wallets before initiating payments. This approach holds the promise of diminishing dependence on physical cash, simplifying cross-border transactions, and cutting down both transaction costs and time.

Since it serves as an alternative to physical cash, CBDC will be issued in denominations akin to coins and paper notes. This will enable both Person-to-Person (P2P) and Person-to-Merchant (P2M) transactions.

How will e-Rupee be implemented?

There are two primary methods:

1. Token-based CBDC: Similar to cash transactions, ownership transfers immediately without recording against a legal entity.

2. Account-based CBDC: Involves Central or commercial banks holding CBDC accounts, requiring identity verification and often used for interbank settlements.

RBI will issue two types of CBDCs1:

CBDC-R (General Purpose or Retail-CBDC): Available for use by all, including individuals, businesses, etc.

CBDC-W (Wholesale-CBDC): Designed for interbank transfers and wholesale transactions.

Source: e₹—The digital currency in India: Challenges and prospects. Haque & Shoaib (2023)2

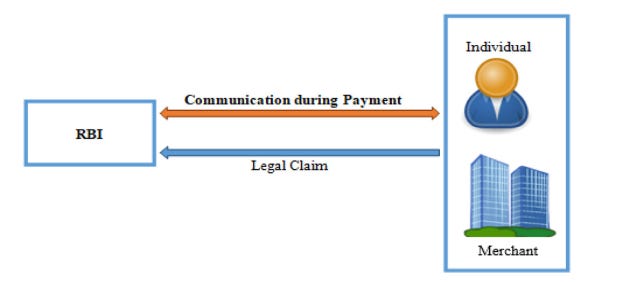

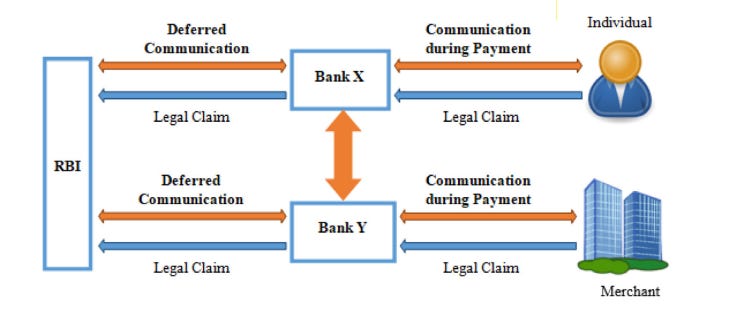

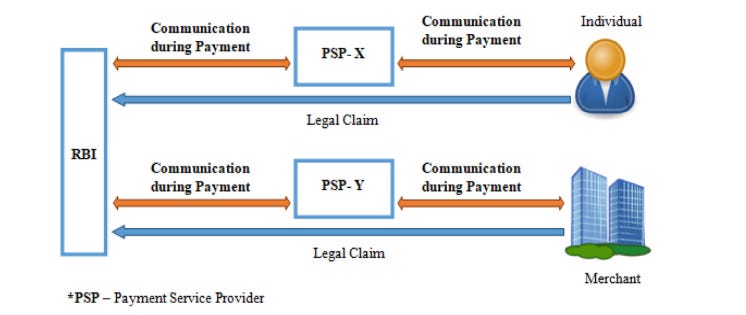

CBDC transactions follow one of the following three models:

Direct Model: Central authority (RBI) handles all transactions.

Indirect Model: Both RBI and decentralized nodes (banks and service providers) process transactions.

Hybrid Model: Combines elements of both direct and indirect models.

Technology?

The technology behind CBDC can be based on a centrally controlled database or Distributed Ledger Technology (DLT) such as blockchain. No official confirmation has yet been issued by the RBI.

Will the CBDC earn interest?

No, CBDC, like physical cash, will be non-interest bearing, aligning with its intended use.

Anonymity of Transactions

While all digital transactions leave traces, RBI stated that CBDC-R will offer "some degree of anonymity," particularly for small transactions, although specific terms remain undefined. RBI emphasizes that CBDC complements, rather than replaces, existing forms of money, ensuring that physical cash remains relevant.

On September 4, 2023, the State Bank of India announced interoperability of e-Rupee with UPI. This implies same digital infrastructure for UPI and CBDC, ensuring seamless integration while simultaneously reducing implementation costs. For consumers, it means: if you have an account with SBI and wish to avail e-Rupee, you can access the same via “e-Rupee by SBI” application, and the same will be interoperable with your SBI account linked to UPI.

As of June 2023, the e-Rupee pilot boasts over 13 lakh users and three lakh merchants.

The Digitalization of sovereign currencies and digital payment systems provides an alternative payment system that is less reliant on existing international networks dominated by foreign currencies. This has the potential to enhance financial resilience and influence alliances and partnerships between countries.

CBDCs are poised to advance financial inclusion and counter the popularity of unregulated cryptocurrencies (Bitcoins). E-Rupee, in particular, can curb illicit activities like tax evasion and money laundering. As e-Rupee continues to evolve, it underscores the importance of adapting to the digital era. With its potential to reshape global financial dynamics, e-Rupee embodies India’s commitment to financial inclusion and innovation in the digital age.

Concept Note on Central Bank Digital Currency, Reserve Bank of India Publications, Oct 2022.

Haque & Shoaib (2023) e₹—The digital currency in India: Challenges and prospects (10.1016/j.tbench.2023.100107)